The CFA Institute faces a 40% drop in candidates and plans to revitalise interest in its programme. Key strategies include a global marketing campaign showcasing career impacts, updating the curriculum to reflect the rise of alternative investments, and strengthening industry partnerships. The Institute aims to bridge the value perception gap and attract the next generation of investment professionals by hosting events and competitions in 2024 and maintaining its commitment to excellence.

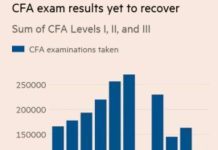

The Chartered Financial Analyst (CFA) Institute, globally recognised for its rigorous certification programme, is confronting an unprecedented decline in the number of candidates pursuing the CFA designation. Once considered the benchmark of excellence in investment management, the CFA programme has witnessed a 40% drop in candidate enrolments since its peak.

In response, the Institute has announced a renewed commitment to reinvigorating interest through targeted marketing initiatives and enhanced curriculum relevance, ensuring its alignment with the evolving needs of the global investment management industry.

The need for a renewed approach

The CFA charter has long served as a critical credential for investment professionals, with its comprehensive curriculum focused on portfolio management, ethics, and financial analysis. Despite its reputation, the decline in candidates reflects a growing value perception gap and challenges posed by shifting industry dynamics. The CFA Institute acknowledges these barriers and aims to address them through strategic interventions that resonate with today’s investment professionals.

What’s driving the decline?

The CFA Institute has outlined a detailed strategy aimed at reclaiming its standing as the premier designation in investment management.

- The value perception gap: One major reason for the decline in interest is the gap between how valuable the CFA charter is perceived to be and its actual value. Many potential candidates question if the significant time, effort, and money required to earn the designation truly leads to meaningful career benefits. To address this, the CFA Institute needs to clearly show the real-world advantages of holding the charter and how it can boost career opportunities.

- Changing industry trends: The investment management industry is changing quickly, with more focus on areas like private equity, hedge funds, and real assets. However, the CFA Institute has been slow to update its curriculum and outreach efforts to match these growing sectors. While the CFA designation is still respected in traditional asset management, it has less recognition and importance in alternative investments—an area that is becoming increasingly important in the industry.

The CFA Institute’s strengths and weaknesses

Success in traditional asset management: The CFA charter is still highly respected in the traditional asset management industry. This is largely due to the CFA Institute’s past efforts, such as creating the Global Investment Performance Standards (GIPS). These standards changed how firms in traditional, long-only asset management report their performance. Because the GIPS were so well-designed, large institutional investors and consultants quickly adopted them as a requirement for evaluating investment firms. Today, almost all long-only firms follow GIPS standards for reporting performance.

Missed opportunities in alternative investments: The story is different in the alternative investment industry, which includes hedge funds, private equity, and other specialized areas. Many professionals in this field, particularly those moving from investment banking roles, have not embraced the CFA designation. These professionals often focus on specific niches and may not see the value in the CFA program’s broader knowledge base. Additionally, the CFA Institute’s poorly handled attempt to create performance standards for alternative investments damaged its reputation in this sector. As a result, very few firms in alternative investments have adopted the GIPS standards.

A path forward for the CFA Institute

To attract more candidates and regain its standing, the CFA Institute must take responsibility and adopt bold strategies to re-establish itself as a key part of the investment management world. Blaming slowing growth in markets like China and India doesn’t address the bigger issues. The Institute should focus on two main goals:

- Launch a strong marketing campaign: The CFA Institute needs to invest in a campaign to bridge the gap between how the CFA charter is perceived and its actual value. This campaign should focus on:

- Educating potential candidates and industry leaders about the career benefits of the CFA designation.

- Highlighting success stories of CFA charter holders across different areas of the investment industry.

- Engage more with the alternative investment industry: The CFA Institute must actively involve itself in the alternative investment sector by:

- Partnering with and advertising in key publications that focus on hedge funds, private equity, and other alternative investments.

- Sponsoring and participating in major alternative investment conferences to increase visibility and relevance.

- Overhauling its performance standards for alternative investments, ensuring they are practical, useful, and relevant to encourage more firms to adopt them.

Ensuring the legacy of excellence

The decline in CFA candidates is not just a challenge but an opportunity for the CFA Institute to innovate and realign itself with industry demands. By addressing these issues with a strategic approach, the Institute can not only maintain but also enhance its legacy as a leading credential for investment professionals.

This renewed focus will empower the CFA designation to continue shaping the next generation of investment leaders, solidifying its role in navigating the complexities of modern financial markets. The time for action is now, and the CFA Institute must lead the charge in ensuring the designation’s enduring impact on the global financial industry.

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.